In 2022, e-commerce experienced a marked transition. After the boom of 2020, its share in global trade decreased, giving way to a resurgence of interest in physical stores. Even Amazon wants to roll out more points of sale in 2023 !

However, the pandemic continues to have a visible impact : it has accelerated the development of the digital economy by 5 years. Consumers are now more informed, technophile and in search of an ever more personalised experience. Their online purchases are mainly guided by the use of social media. In this context, omnichannel is paramount.

What is the outcome for e-commerce in France ?

Slow but constant growth compared to 2019

E-commerce is slowing down from its crazy post-pandemic growth. Indeed, its share in global trade (12.5 %) fell for the first time in 3 years, after having increased from 10 % in 2019 to 13.4 % in 2020, then to 14.1 % in 2021. But e-commerce remains sharply on the rise compared to 2019.

The key figure : In 2022, the turnover of French e-commerce is 147 billion euros, an increase of 13.8 % in one year.

Source : FEVAD report of February 2023

The increase in the average spend on online purchases in France

The key figure : 42 million French online shoppers buy on average 3,515 euros worth of products per year online. This figure has continued to increase, with a clear upward trend from 2020, for an annual growth rate of more than 14 % over the last two years.

The key figure : The average online spend was 65 euros in 2022, up 7 % in one year.

Source : Médiamétrie

How to retain cyber buyers in the face of economic challenges ?

The increasing attention of cyber buyers towards their expenditure

Yes, all the numerical indicators are looking good for e-commerce. But the spectre of the economic crisis is looming and its effect on purchasing behaviours is already being felt. As we had already noted at the beginning of the year, 9 out of 10 French people say they are paying more and more attention to their expenditure. Digital has become a powerful anti-inflation weapon for many French people looking for good deals, especially among the younger generations. In a tense economic climate, cyber buyers are always more difficult to retain.

Online purchases on promotion and second-hand

Among Generation Z, 64 % of online shoppers say they have focused their purchases on the products they believe are necessary this year (6 points more than the entire population of online shoppers). Almost as many say they have bought more products on promotion (8 points more than the general population). Second hand items are also very present in their online purchases.

The key figure : 2 out of 3 young people bought a refurbished or second-hand product online in 2022.

Source : survey on online shopping practices by Odoxa for FEVAD

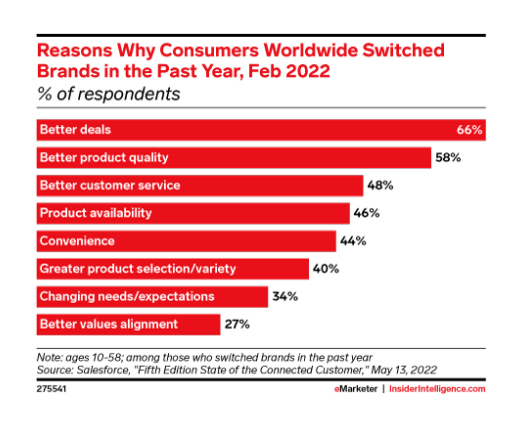

Hunting for deals : customers abandon their favourite brand

In this economic climate, it is now increasingly difficult to retain customers who change brands, moving towards better and better deals.

Read also : Subscription economy : are we heading towards an El Dorado of loyalty ?

The key figure : In 2022, 7 out of 10 consumers have already bought from a competitor of their favourite brand, most of them to benefit from good deals.

Source : Insider Intelligence/eMarketer article of May 2022

Source: Salesforce, “Fifth edition state of the Connected Customer” published in the article Insider Intelligence/eMarketer de mai 2022

The growing impact of social networks on online purchases

Social commerce in full swing after the pandemic

The key figure : 97 % of Generation Z say that social networks are their primary source of inspiration in terms of shopping.

At the end of the pandemic, another trend has not lessened in intensity : social commerce. With 1 billion TikTokers by 2025, we can imagine that social commerce still has a bright future ahead of it !

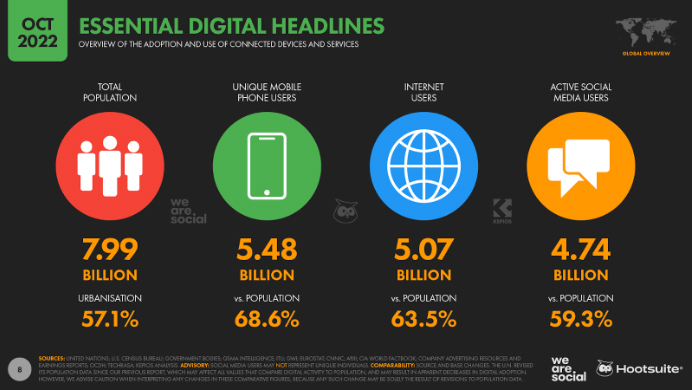

The key figure : Gradually, the number of social network users (4.74 billion) is catching up with that of Internet users worldwide (5.07 billion).

Source : globaler digitaler Bericht von Oktober 2022 von We Are Social in Partnerschaft mit Hootsuite

Today, social commerce is estimated at 992 billion dollar worldwide. Its potential is expected to reach 2.9 trillion dollar by 2026. This is why retailers attach importance to social commerce. Meta, Google and Amazon remain at the forefront of their preferred distribution and communication channels.

Attract online shoppers through proximity and personalisation

Personalise online shopping

The personalisation of the relationshipis an essential key to attracting and retaining increasingly volatile and opportunistic online buyers. Technology holds a prominent place : conversational commerce, voice interfaces, artificial intelligence and virtual and augmented reality have become allies of e-merchants. With the acceleration of the use of version 4 of ChatGPT, some merchants have inaugurated chatbots to advise buyers in a smarter way.

Example : Klarna, a Swedish fintech offering online factoring solutions, has announced the implementation of an integration with ChatGPT to provide a seamless shopping experience. Klarna has developed a partnership with OpenAI, the company behind ChatGPT, to allow ChatGPT users to make purchases directly via the chatbot.

Source : Klarna

Create conversational interfaces for greater proximity

This quest for proximity also pushes e-merchants to favour conversational interfaces.

Example : WhatsApp has, within a short space of time, become a place of purchase... and payment ! Its new payment feature allows Singapore-based users to pay businesses directly from the app. It thus offers a more convenient and frictionless experience for users and businesses, allowing them to make payments with ease when interacting with businesses on WhatsApp.

Source : Techcrunch

The development of voice shopping

Finally, paired with the emergence of voice recognition technologies, this trend has contributed to the development of voice shopping. In the United States, the turnover of voice shopping has increased from 2 billion dollar in 2017, to 40 billion dollar in 2022.

This is enough to give retailers food for thought when it comes to their purchase and payment journeys, which are profoundly modified by the use of voice.

Streamline payment for an instant and personalised experience

Optimise the payment experience to increase online conversion

In this landscape of e-commerce habits and trends, the payment stage is more decisive than ever to guarantee the customer's ability to complete their purchase journey on any channel. The quality of the payment experience remains crucial for online conversion.

The Edgar Dunn firm analysed the payment forms of the 100 largest French e-merchants and surveyed the French on their expectations. It identified several key factors guaranteeing the best conversion. In the lead : the speed and intuitiveness of the payment stage.

The key figure : After 3 minutes, more than half of customers give up on their purchase.

The display of logos logos on payment security also appears to be decisive in reassuring online buyers. Finally, the choice of the mix of payment methods offered is an essential criterion.

The key figure : 82 % of French online shoppers say they regularly abandon their cart because their preferred payment method is not offered.

Source : A study by Edgar Dunn

Digital payment applications for young people

While credit cards remain in pride of place in France for 84 % of online shoppers, digital payment applications (Lyf, PayPal, Apple Pay, etc.) have made a remarkable breakthrough, especially among young people.

The key figure : More than half of 18–25 year olds used digital payment applications in 2022 (compared to 39 % of the entire population).

Source : Survey on online shopping practices by Odoxa for FEVAD

Read also : Split payment : a delicate balance between fluidity, instantaneity and security

New online shopping trends and challenges for retailers

In short, what should be retained from the evolution of e-commerce since 2022 ? Here are our conclusions :

- Post-Covid society has undeniably evolved in its online shopping behaviours.

- Consumers oscillate between opportunism and the search for personalisation in their ways of buying online, guided by ever-better deals and arbitration on spending in times of economic crisis

- This trend pushes retailers to innovate and design flexible paths, regardless of the channels used, from inspiration to the conclusion of the transaction.