The news came on 29 March : Apple is embarking into BNPL with Apple Pay Later. This split payment solution allows you to spread a payment over 6 weeks in 4 payments without fees. This official launch speaks volumes about the future potential of payment facilities. Provided that security and customer experience follow ! Explanations.

What is split payment ?

BNPL, split payment, deferred payment, staggered payment

The staggered payment method is a service that often gœs by several names : payment facilities, payment in a number of instalments, split payment, deferred payment, « payment in x instalments without fees », and « Buy now, Pay later » (BNPL).

What are the characteristics of split payment ?

- A repayment period in 3 or 4 instalments, less than a period of 3 months

- No credit interest, but fees

Is split payment considered credit ? Not according to the law ! Cash advance fees are the responsibility of the merchant, or even shared with the customer.

The rise of split payment since 2010

Split payment saw a resurgence of interest in the aftermath of the promulgation of the Lagarde Law (2010), which profoundly changed the credit landscape in France.

Intended to strengthen protection of the French consumer, this law put a stop to the credit reserve, traditionally used in commerce and linked to private brand cards.

Payment facilities have grown rapidly, following the rise of e-commerce, taking advantage of the free space left by other payment methods.

Split payment became a social phenomenon from 2018, well before the explosion of digital transactions during the pandemic.

Split payment : a powerful purchasing lever

2 out of 3 French people use split payment

Today, split payment has become a real purchasing lever, in retail outlets as well as online. It acts on 3 key indicators : the average spend, conversion and customer loyalty.

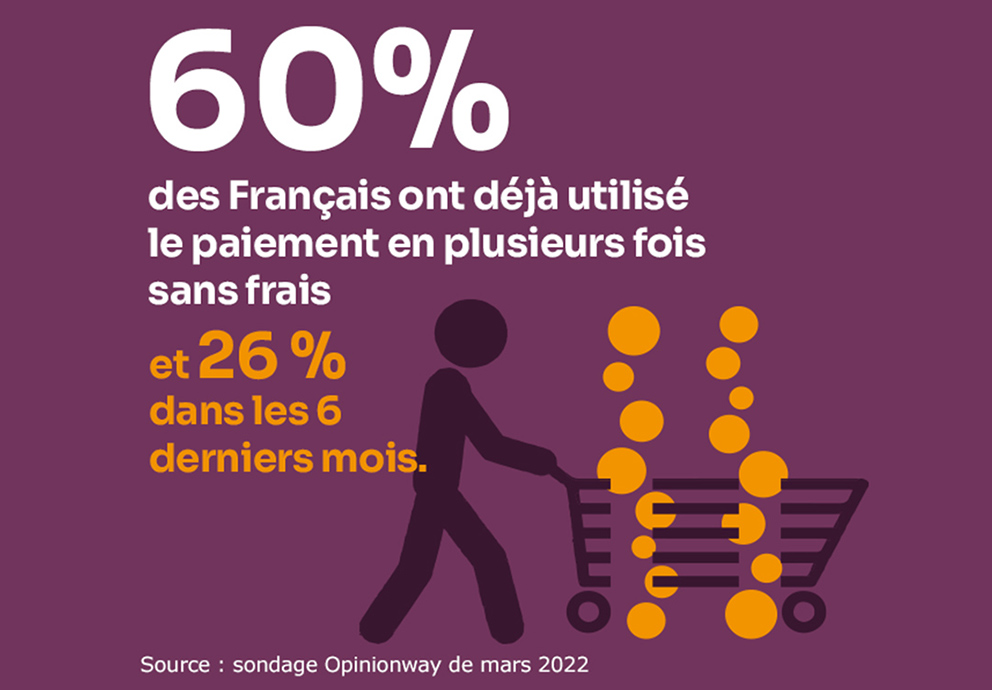

The key figure : 60 % of French people have already used payment in several instalments without fees and 26 % in the last 6 months.

Source : OpinionWay poll of March 2022

Read also : In 2023, the French reveal their purchasing behaviours

Increase the average spend thanks to staggered payment

Split payment allows consumers to split the amount of a purchase into several payments, which increases their purchasing capacity and therefore the average spend.

The key figure : 50 % of French people say they would spend more if they had the option to pay in several instalments without fees.

The purchase amounts envisaged are 15 to 20 % higher on average, whether to finance the installation of a boiler, the purchase of a sofa, a refrigerator, a smartphone or a piece of jewellery.

Source : Exton Consulting

Split payment and conversion

BNPL can also increase conversion by reducing barriers to purchase and allowing consumers to spread their payment.

The key figure : For more than three-quarters of French people, the option to pay in several instalments is a factor in deciding to switch brands.

Source : OpinionWay

Retain customers with split payment

The last key indicator of BNPL, customer loyalty.

The key figure : 90 % of consumers believe that paying in 3 or 4 instalments would encourage them to return to the same merchant.

Source : Mix Factory

Read also : Subscription economy : are we heading towards an El Dorado of loyalty ?

Split payment : a solution to finance your projects

The flexibility of payment solutions is a means identified by the French to carry out their projects, while preserving their savings.

The key figure : nearly 30 % of French people say they are willing to use payment in 3 or 4 instalments without fees to carry out their projects for 2023.

The 3 projects cited as a priority by the French are travel, renovations and interior design.

Source : CSA study carried out by Cofidis in November 2022

Beware of unnecessary expenses !

However, consumers are still well aware of the dangers of excessive use of these payment facilities.

The key figure : 66 % of French people believe that these payment facilities encourage them to buy products they do not need.

Source : OpinionWay poll of March 2022

According to the same study, 62 % of French people say that payment facilities make it more difficult to track expenses. These are all arguments that have also caught the eye of the regulator.

Towards a legal framework for split payment

A risk of debt overhang

The development of split payment is not without risk. In recent years, consumer associations have been drawing attention to the risk of debt overhang related to payment facilities.

Example : Klarna, a Swedish fintech offering online factoring solutions (one of the emblematic players of the market) has had to face campaigns led by detractors around the injunction « Stop the Klarnage » (a pun referring to the carnage allegedly caused by Klarna to the finances of its users).

A European regulation of split payment

The trends have alerted European regulators. Evidence from 3 (countries) :

In Germany : Schufa estimates that one in two young Germans has already contracted « Klarna debts », as they are called on social networks. These debts can potentially lead to uncontrolled debt situations.

In the United Kingdom : the FCA has warned of the urgent need to regulate these credits which are not really credits at all. The number of debt overhangs has increased since the pandemic and the amount of BNPL transactions has increased fourfold between January and December 2020.

In France : a parliamentary mission on debt overhang was set up in 2021 under the leadership of deputy Philippe Chassaing.

Include payment facilities in the law

This European awareness is catching on. A revision of the European Consumer Credit Directive is currently under discussion. Some countries have already changed their regulatory framework.

Its first guidelines provide for the inclusion of payment facilities within the framework of the law, while maintaining a certain flexibility in the granting rules.

The goal : to preserve the innovation capacity of the actors who have contributed to the success of split payment.

A delicate balance between security and fluidity of the customer journey

Score to spread the payment

How to successfully transform a payment journey ? By offering a simple, seamless and perfectly secure journey.

This is the case of Klarna and PayPal, whose solutions make it possible to instantly score the customer to grant them the option to spread their payment.

Open banking to control the creditworthiness of customers

The actors of split payment have worked hard on their scoring algorithms. Their goal : to make sure their customers were solvent.

To do this, they use open banking, which allows them to automatically retrieve data on their customers' banking transactions (income estimate, transaction history, expenditure analysis, etc.).

This technique helps them assess the creditworthiness of their customers. This is an essential step in order to avoid unpaid rates, especially for transactions that are not assimilated to credit.

The new European directive also encourages this practice of credit checking.

Split payment : towards secure budget management

In short, what should be retained from split payment in this context of complete upheaval ? Here are our conclusions and prognoses for the future :

- Split payment is a real purchasing lever, in retail outlets as well as online.

- Stricter regulation to avoid debt overhang will pave the way for increasingly popular payment options among consumers, offering them a more secure framework to manage their budget.