In 2023, payment will either be by mobile or it will not be made at all ! Mobile payment seems to be spreading at a fast pace : a number of factors have finally aligned to enable its adoption by the French. Is it an alternative to the use of cash, highlighted by the ECB's data ? Yes and no : certain cyclical elements, such as inflation, also favour a return to cash.

Smartphones and digital innovations : the new momentum of mobile payment in France

Widespread adoption of smartphones

In France, the conditions are now conducive to enable mobile payment to progress quickly. Firstly, in terms of equipment, with a smartphone penetration rate that rose to 87 % of the population in 2022 (compared to only 28 % in 2012).

The key figure :The smartphone penetration rate is 97 % for 18–24 year olds and 25–39 year olds.

Source : Statista, Mobile e-commerce in France.

The rise of digital commerce

The sharp increase in digital habits has enabled this evolution. The pandemic has therefore had a strong accelerating effect on online shopping behaviours, at the same time promoting the development of mobile shopping.

The key figure : Between 2019 and 2020, the percentage of online shoppers has increased from 71 % to 82 %, rising to 84 % today.

Source : Statista, Mobile e-commerce in France.

Read also : Social commerce : moving towards democratisation ?

The QR code, a symbol of the mobile payment revolution

Another consequence of the pandemic, QR code technology has managed to make a place for itself amid the general public.

The key figure : The prominence of QR codes has doubled between 2020 and 2022, thus strengthening the adoption of mobile payment solutions based on this technology.

Source : Statista, Mobile e-commerce in France.

The rise of m-commerce in France

Mobile, the preferred channel for online purchases

With these favourable conditions, mobile commerce has widely taken root in the habits of French consumers.

The key figure : In 2023, 76 % of e-commerce site traffic comes from mobiles, and 61 % of online orders are placed from a smartphone.

Source : Statista, Mobile e-commerce in France.

In terms of shopping behaviours, the cart abandonment rate is slightly higher on mobiles (89 %) than from a computer (80 %). The most frequently-purchased goods are clothes (for 60 % of mobile users), followed by shœs (40 %), and then books (38 %).

Why choose mobile for your purchases ?

The main reasons that buyers put forward for choosing to buy from a mobile are :

- Flexibility, for 58 % of them (i.e. being able to buy where and when you want)

- Ease of access (for 57 %)

- Speed of the transaction (for 40 %)

The diversity of payment methods appears only in the last place (cited by 14 % of respondents only), while it is an important decision factor for e-commerce. On mobile devices, the speed and ease of the transaction take precedence ; the preferred means of payment is often saved by default in users' wallets.

What are the obstacles to m-commerce ? Difficulty viewing the products (for 31 % of respondents) and the security of the transaction (for 27 %). In this context, some brands have gained a privileged place in the landscape of mobile payment solutions.

Mobile payment : who are the market leaders ?

Mobile payment : between adoption and reluctance

The rise of m-commerce in France is accompanied by an increasing adoption of mobile payment among consumers. Thus, the percentage of French people who wish to always pay with their mobile has risen to 24 %, when 16 % would like to reserve it for everyday purchases and 14 % would use it in bars, restaurants and transport.

Source : Statista Consumer Insights, June 2023

Despite the popularity of mobile payment, 31 % of respondents express a reluctance to use it for their transactions.

Which brands benefit the most from mobile payment ?

This increasing prevalence of mobile payment benefits the most recognised brands.

The key figure : Apple Pay dominates the mobile payment market in France, with 63 % of users, an increase of 20 points in two years. It is ahead of PayPal (39 %), Google Pay (31 %), Paylib (17 %) and Lydia (13 %).

Source : Statista Consumer Insights, June 2023

Read also : Split payment : the end of the state of grace

Growth of mobile transactions : vigilance against increased risks

Mobile transactions : a meteoric rise

The volume of transactions via mobile payment has increased dramatically.

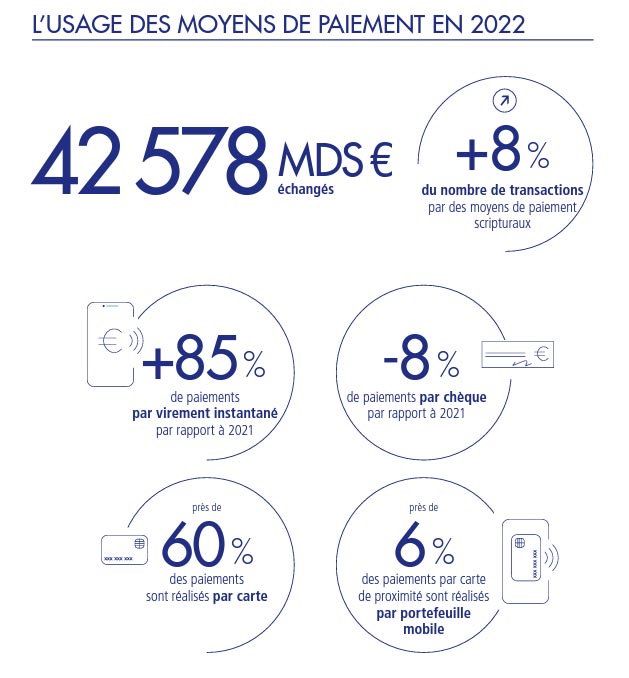

The key figure : Contactless mobile payment transactions more than doubled between 2022 and 2023, showing a growth of 137 %.

Today, they represent nearly 6 % of in-person card payments and 10 % of contactless payments.

Mobile payment is not without risk !

However, the OSMP warns of the increasing risks associated with the rise of mobile payment. The increase in proximity payment fraud is mainly due to contactless mobile transactions, which account for more than 50 % of fraudulent amounts in proximity. The majority of these frauds result from the addition of stolen cards to wallets.

Read also : Payment fraud : increased efficiency, reimbursement of victims to be improved

How to heighten the security of mobile payments ?

In view of these challenges, the Observatory has made recommendations to ensure the security of mobile payments. These guidelines are for payment service providers, who are invited to strengthen the procedures for adding cards, subject to strong authentication, as well as the transaction itself. Users also have their part to play : they are encouraged to adopt secure practices when using their mobile, such as favouring reliable Internet connections, choosing trusted applications and installing regular updates.

Mobile payment services : an expansion supported by transactional innovations

Mobile payment services are gaining ground

The majority of French people say they use mobile payment services, and some uses are experiencing significant growth. For example :

- Digital loyalty cards, used by 67 % of respondents (6 more points in one year)

- Vouchers and digital gift cards (for 43 % and 49 % of respondents)

- Digital wallets (considered by 43 % of respondents for future use, i.e. 3 more points in one year)

Source : OpinionWay barometer for Lyf « The French and mobile payment services » published in April 2023

Olympic Games 2024 : a springboard to boost the adoption of mobile payments

Major events, such as the Paris 2024 Olympics, could boost the adoption of mobile payments. Visa, having obtained exclusivity of the payments in the official souvenir shops, could replicate the success it enjoyed during the Tokyo Olympics in 2020. As a reminder, Visa recorded 100 million mobile transactions during this event : an increase of 50 % compared to the Rio Olympics in 2016. It will be a great opportunity to encourage the transition to mobile payments.